NBK Mobile Banking

A New Experience

Tailored For You

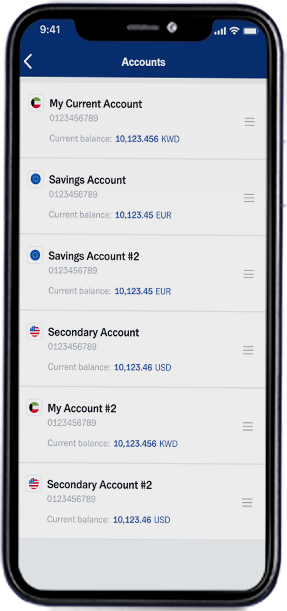

The new NBK App is here and it is all about you. Enjoy a personalized login and dashboard experience, faster transactions, new profile center and much more.

Manage Your Finances

In Your Own Way

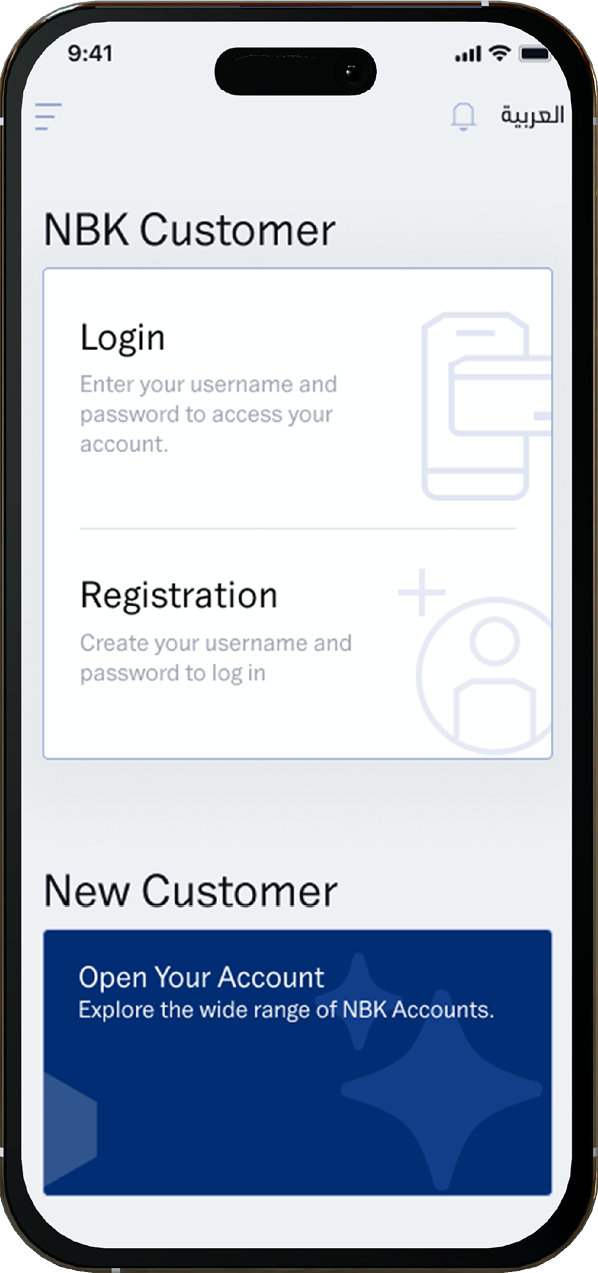

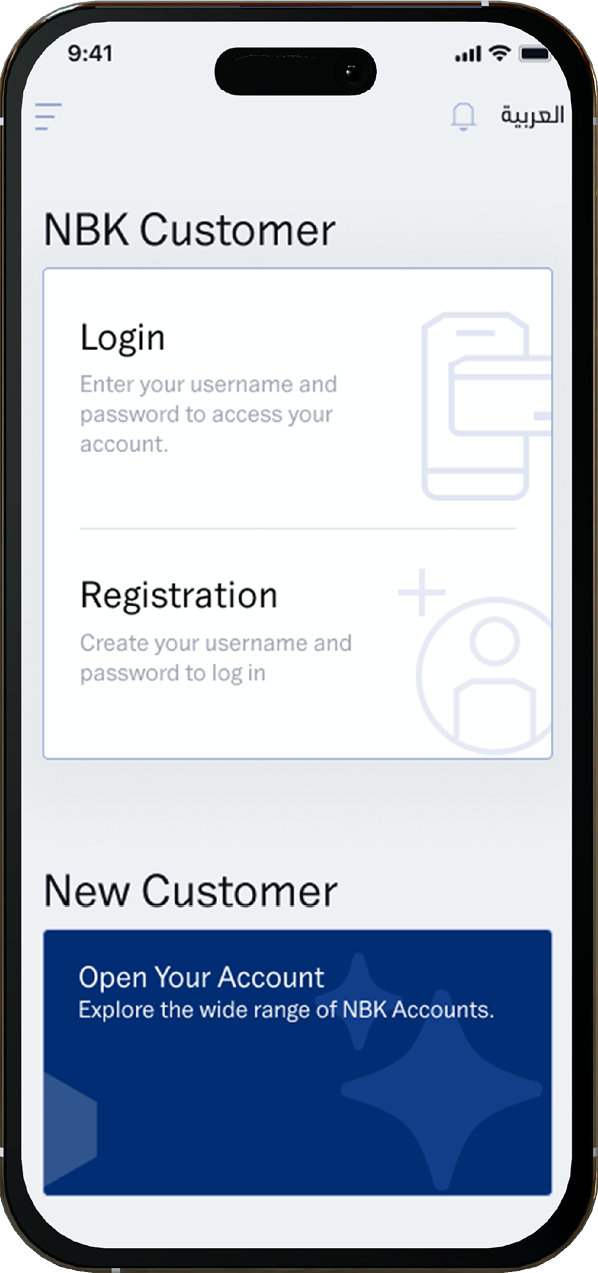

You Can Become a Customer Easily

Joining us as an NBK Customer has become faster and easier now. Open your NBK Account with simpler steps via NBK Mobile Banking App.

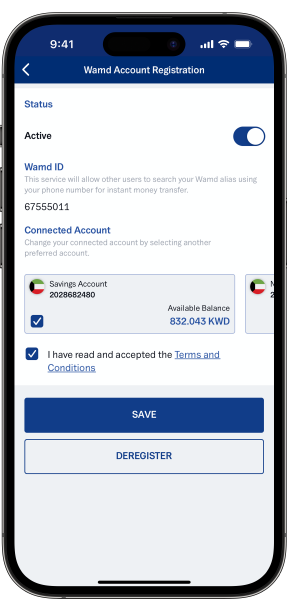

WAMD

Send and receive money instantly using a mobile number.

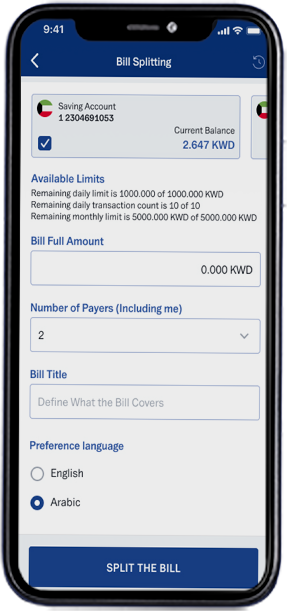

Bill Splitting

Split the bill with up to 20 users with NBK Bill Splitting.

NBK Savings Account

With NBK Savings Account, you can earn interest with the ability to withdraw from the account and transfer your money at the same time.

Open your account today via NBK Mobile Banking App.

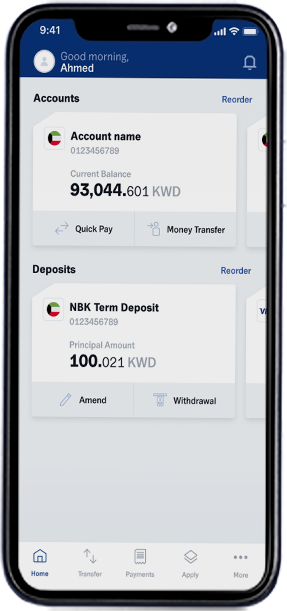

NBK Deposits

Easily open any of NBK Deposit Accounts, such as NBK Term, Flexible Term or Partial Withdrawal Deposit.

Manage Your Finances Easily

With NBK Mobile Banking

You Can Become a Customer Easily

Joining us as an NBK Customer has become faster and easier now. Open your NBK Account with simpler steps via NBK Mobile Banking App.

WAMD

Send and receive money instantly using a mobile number.

Bill Splitting

Split the bill with up to 20 users with NBK Bill Splitting.

e-Payments

With e-Payments, you can pay phone bills, purchase your e-cards for video games and PlayStation and much more.

NBK Savings Account

With NBK Savings Account, you can earn interest with the ability to withdraw from the account and transfer your money at the same time.

Open your account today via NBK Mobile Banking App.

NBK Deposits

Easily open any of NBK Deposit Accounts, such as NBK Term, Flexible Term or Partial Withdrawal Deposit.

NBK Products

NBK Products

Easily open an account, apply for a loan, credit or prepaid card in few clicks.

Contact Details

Contact Details

Update your personal information through NBK Mobile or Online Banking without visiting the branch.

Salary Transfer Certificate

Salary Transfer

Certificate

Generate your own salary transfer certificate easily.

Cash Advance

Cash Advance

Transfer money from your credit card to your account easily and faster.

Apply for a Loan

Loan

Without Salary Transfer

Apply and start paying for your installments after a year. Simply login to NBK Mobile Banking and choose to apply, the loan type, amount and duration.

Managing Cards

Managing Cards

During Travel

Avoid declined transactions when traveling abroad by notifying NBK about your travel ahead of time.

Cards and Accounts Activation

Activation

Activate new NBK Credit, Debit or Prepaid Cards and dormant accounts.

Transfer Limit Increase

Transfer

Limit Increase

You can increase your monthly transfer limit from KD 2,000 up to KD 30,000.

Standing Orders

Standing Orders

Establish standing orders with automatic payments between accounts or for recurring bills.

Prepaid Card Load

Prepaid

Card Load

Load or unload NBK Foreign Currency Prepaid Card.

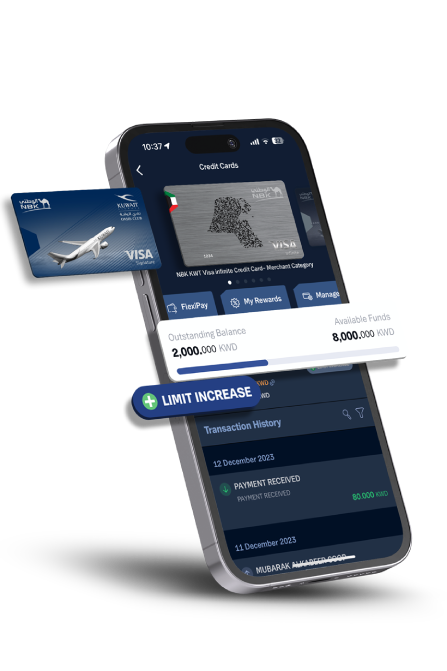

Credit Card Limit Increase

Credit Card

Limit Increase

Increase your credit card limit simply by signing the Ci-Net consent form electronically with a few easy and simple steps.

Additional Benefits

-

Safety and Security

Report lost or stolen NBK Card with issuance of a replacement instantly.

-

Cardless Withdrawal

You or a beneficiary of your choice can withdraw cash from any NBK ATM or CDM with Civil ID or mobile number.

-

View Earned Points

You can easily view and redeem your accumulated NBK Miles Points, Rewards Points, Goal Points and KWT Points.

-

Block Debit and Prepaid Cards

You can temporarily block debit and prepaid cards and unblock them.

-

Investment Transfers

Easily transfer to your NBK Brokerage Account and NBK Invest Account.

-

Confirm Payments

You can confirm all online payment transactions directly and easily through the app without the need to enter the OTP.

-

Digital Branch Queue Number

Get your digital queue number prior to arriving to NBK Branches through "My Ticket" on NBK Mobile Banking App.

-

Checkbook Request

Request a checkbook.

-

Branch Locator

Easily find your nearest NBK Branch, ATM or CDM across Kuwait.

-

Contact Us

Contact us by calling from inside and outside Kuwait or through our social media networks.

-

Using the App

on Smartwatch

You can use the app on Android and iOS smartwatches. Simply download the latest version of NBK Mobile Banking App and pair it with your smartwatch to enjoy the new features, like: view your account or credit card balance, view the last 5 transactions on your account or credit card and check the foreign exchange rate from Kuwaiti Dinars to other currencies.

Enjoy

Various Benefits

With NBK Mobile

Banking

FAQs

To avoid delays in money transfer or request additional information, please follow the below tips:

• Refrain from using abbreviations, codes or nicknames in the "Details" field of your payment order

• Make sure to fill in the full details of "Purpose of Payment"

• Add the beneficiary’s full name and address, including the city and country

You can register your NBK Mobile Banking account on up to 3 devices. You can also manage the number of devices registered to the service by tapping on your profile then "Device Management".

Yes, you can log into the app using your touch or face ID, but first you need to activate the option on your mobile.

• We will not ask you to save your personal details on the device when using the app

• Your password won't be saved on your device

Once you are registered on NBK Mobile Banking, you will get a transfer limit of KD 2,000 monthly and you can increase it up to KD 30,000.

• Daily limit: KD 3,000

• Daily transactions: 10

• Monthly limit: KD 10,000

• Daily limit: KD 1,000

• Daily transactions: 5

You can change the display of the account balance by tapping on your profile then tapping on "Smartwatch" and select one form of to be displayed, either "Percentage Value" or "Amount" and that applies on both accounts and credit cards.

You can only display one account or credit card. If you need to select another account or credit card, you must change the account by tapping on the account or credit card you desire to be displayed.

You can activate NBK Geo Alerts by going to your profile in NBK Mobile Banking App settings and scrolling to "Enable NBK Geo Alerts".

Another pop-up message will ask for access to your location, after subscribing to this service even when you are not using the app, tap on "Always Allow". In order to get the notifications, make sure you enable Bluetooth and Wi-Fi.

A pop-up message will ask your permission to use your device’s Bluetooth, tap "Accept".

To deactivate the service, log into NBK Mobile Banking App, go to your profile, scroll to "NBK Geo Alerts", then uncheck the tick on "Enable NBK Geo Alerts".

If you are not registered yet, ensure to downloaded the latest version of the app and follow the on-screen instructions.

Yes, you can save the trip to the branch and do the updates through the application from the comfort of your home, office or abroad.

WAMD is a service provided by K-Net on NBK Mobile Banking App, where users can easily send and receive money locally.

Kuwaiti Dinar is the currency used for WAMD across all local banks.

• KD 1,000 is the maximum limit per transaction

• KD 3,000 daily limit

• KD 20,000 monthly limit

Login to NBK Mobile Banking App, go to "Transfers", then to WAMD. You can enable or disable the service, change the settlement account or deregister to the service all in simple taps.

Find Us

Find Us 1801801

1801801