Thahabi Debit Card

Features and Benefits

-

Personal Banking Officer

A Personal Banking Officer assists you with financial planning, portfolio management, financial goals assessment, advice on products and more.

-

Accessibility and Convenience

Pay at millions of Point of Sale (POS) locations worldwide and withdraw up to KD 3,000 cash at over a million ATMs, locally and internationally.

-

Family Banking Services

Now with Family Banking Services from NBK, you can share premium services with your family members.

-

High Spending Power

Spend up to KD 20,000 locally and KD 15,000 internationally at Point of Sale (POS) terminals. Spend up to KD 5,000 daily and KD 10,000 monthly on online purchases.

-

Global Banking Experience

Get access to global account, international mortgage, international real estate and emergency cash at counter.

-

Premium Concierge Service

You can benefit from concierge service including messenger services, limo service, travel bookings and airport services.

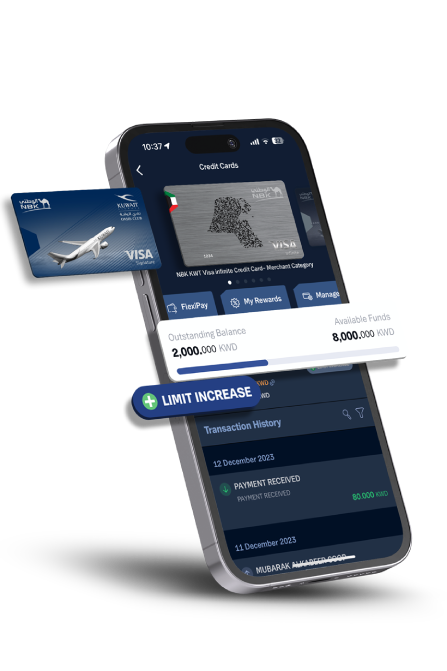

Download Our

App Today

And Enjoy

Endless Benefits

Fees and Criteria

All

Thahabi

customers

Minimum salary of

KD 1,500

to be eligible

KD 10

fee for

a replacement card

FAQs

You cannot exceed the below transaction limits per day:

- 15 ATM withdrawals

- 25 POS transactions

- 5 online transactions

NBK makes sure our cardholders are as safe as possible. If your card is lost or stolen, contact NBK Call Center immediately at 1801801 when calling from within Kuwait or dial +965 2224 8361 when calling from abroad. NBK Call Center Representative will immediately block your card from unauthorized transactions.

It is always best to pay in the currency of the country you are visiting, because NBK exchange rates are very competitive. Remember to only use KD in Kuwait.

Yes, you can withdraw cash from any of NBK’s conveniently placed ATMs. You can also withdraw 100% of your available funds.

To become a Thahabi Package customer you must meet one of the following criteria:

- Your monthly salary must be transferred to NBK, if not already, and must be between KD 1,500 to KD 2,999*

- Alternatively, you can deposit KD 30,000 or more in any interest or non-interest bearing NBK Account including Al Jawhara Account, NBK Term Deposit or any investment funds for 3 consecutive months*

*If the average salary, account or fund balance falls below the minimum required amount for three consecutive months, a monthly service fee of KD 25 will be deducted from your personal account at the bank or Thahabi Package services will be discontinued.

You can withdraw up to KD 3,000 daily, locally and internationally.

You can make a transaction of up to KD 20,000 locally and KD 15,000 internationally at POS locations.

Find Us

Find Us 1801801

1801801